Beneficial

Simple, swift access right from your phone. Only a single document needed to apply

Simple, swift access right from your phone. Only a single document needed to apply

A direct lender with a modern approach to reliability. We secure your data and support you in challenging conditions

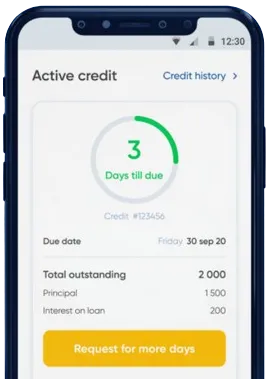

Easy, quick fixes from the comfort of your home. Instant transfer and loan extension opportunities

Make your request in the app, just complete the form.

Wait for our quick decision, which takes only 15 minutes.

Accept your funds, normally transferred in about one minute.

Personal loans have become increasingly popular in Kenya due to the numerous benefits they offer to individuals seeking financial assistance. Whether you need funds for starting a business, paying for education, or covering unexpected expenses, personal loans can provide the financial support you need.

One of the main benefits of personal loans is the flexibility in how you can use the funds. Unlike other types of loans that are specified for a particular purpose, personal loans in Kenya can be used for a variety of needs, such as debt consolidation, home renovation, medical bills, or even travel expenses.

Overall, the flexibility in the use of personal loans makes them a versatile financial tool for individuals in Kenya.

Personal loans in Kenya are known for their quick approval process, allowing borrowers to access funds within a short period of time. Whether you apply for a personal loan online or through a traditional bank, the streamlined application process and minimal documentation requirements make it easy to get the funds you need quickly.

Compared to other types of loans, personal loans in Kenya often come with competitive interest rates. This makes them an attractive option for individuals looking to borrow money without paying exorbitant interest fees.

Another benefit of taking out a personal loan in Kenya is that it can help improve your credit score. By making timely payments on your loan, you demonstrate financial responsibility to credit bureaus, which can positively impact your credit score over time.

Personal loans in Kenya offer a range of benefits to individuals looking for financial assistance. From flexibility in use of funds to quick access to money and competitive interest rates, personal loans can help you achieve your financial goals and improve your overall financial well-being. Consider exploring personal loan options in Kenya to see how they can support your financial needs.

A personal loan is a type of loan that helps individuals borrow a specific amount of money from a bank, credit union, or online lender. This money can be used for various personal expenses, such as home improvements, medical bills, education, or debt consolidation.

Any Kenyan citizen or resident who meets the lender's eligibility criteria can apply for a personal loan. Typically, lenders require borrowers to be 18 years or older, have a steady source of income, and a good credit history.

Common documents needed to apply for a personal loan in Kenya include proof of identity (ID card or passport), proof of income (pay slips or bank statements), proof of residence (utility bills), and in some cases, references from employers or acquaintances.

The approval process for a personal loan in Kenya varies depending on the lender. Some lenders may provide instant approval online, while others may take a few days to process the application and verify the required documents.

The interest rate on a personal loan in Kenya is determined by various factors, such as the borrower's credit score, loan amount, loan term, and the lender's policies. Generally, borrowers with higher credit scores are offered lower interest rates.

Yes, you can use a personal loan to start a business in Kenya. However, it is important to consider the risks involved and ensure that you have a solid business plan in place before applying for a loan.